Investing in real estate can be an excellent way to build wealth, generate passive income, and diversify your investment portfolio. Buying property for investment purposes involves purchasing residential, commercial, or mixed-use properties with the expectation of earning a return on investment through rental income, property appreciation, or both. This article we are introducing you the best place to buy property in Cambodia and provides an overview of key considerations and benefits associated with buying property for investment.

How to Identify The Best Place

Determining the best place for buying property involves considering various factors that can influence the value, profitability, and suitability of the investment. These factors may vary depending on individual preferences, investment goals, and the specific context of the real estate market. Here are some key factors to consider:

- Location: The location of the property is often the most critical factor affecting its value and investment potential. Factors to consider include proximity to amenities (schools, hospitals, shopping centers), transportation links, safety, and neighborhood reputation.

- Economic Growth and Stability: Investing in areas with strong economic growth and stability typically offers better prospects for property appreciation and rental income. Consider factors such as job growth, business development, infrastructure projects, and overall economic indicators.

- Property Market Trends: Analyze local property market trends, including historical price appreciation, rental yields, vacancy rates, and supply-demand dynamics. Understanding market trends can help identify areas with potential for growth and profitability.

- Rental Demand: Assess the rental demand in the area, especially if you’re considering buying property for rental income. Look for areas with high demand from tenants, low vacancy rates, and potential for rental growth.

- Property Type: Determine the type of property that best suits your investment goals, whether it’s residential (apartments, houses), commercial (office spaces, retail units), or mixed-use properties. Consider factors such as demand, maintenance costs, and potential returns for each property type.

- Infrastructure and Development: Evaluate the existing infrastructure and ongoing development projects in the area, including transportation networks, utility services, and public amenities. Investments in areas with planned infrastructure improvements often yield better long-term returns.

- Regulatory Environment: Understand the legal and regulatory framework governing property ownership and investment in the area, including property taxes, zoning regulations, land-use policies, and foreign ownership restrictions.

- Risk Factors: Assess potential risks associated with the investment, such as political stability, currency fluctuations, environmental hazards, and natural disasters. Consider diversifying your investment portfolio to mitigate risks.

- Quality of Life: Consider factors that contribute to the overall quality of life in the area, such as climate, cultural amenities, recreational opportunities, healthcare services, and educational facilities. Properties in desirable locations with a high quality of life often command higher prices and rental demand.

- Long-Term Growth Potential: Look for areas with potential for long-term growth and appreciation, considering factors such as demographic trends, urbanization patterns, and emerging market opportunities.

The Best Place To Buy Property

The best place to buy property in Cambodia depends on various factors as describe above. However, several locations in Cambodia are popular among property buyers and investors due to their economic potential, infrastructure development, and attractiveness for both residential and commercial purposes. Here are a few notable areas:

The Photo of Koh Pech (Diamond Island) the core business center in Phnom Penh, Cambodia.

- Phnom Penh: Cambodia’s capital city, Phnom Penh, is a hub for business, commerce, and culture. It offers a wide range of property options, from luxury condos to affordable apartments. The city’s rapid development, growing economy, and increasing urbanization make it an attractive destination for property investment.

- Siem Reap: Famous for its ancient temples, including Angkor Wat, Siem Reap is a major tourist destination in Cambodia. The city has experienced significant growth in recent years, with developments in infrastructure, hospitality, and real estate. Property investment in Siem Reap can be lucrative due to the steady influx of tourists and the expansion of the hospitality sector.

- Sihanoukville: Located on the coast of the Gulf of Thailand, Sihanoukville has seen substantial growth in tourism and real estate development, particularly in beachfront properties and resorts. The city’s strategic location, port infrastructure, and ongoing investment projects make it a promising area for property investment, although it’s worth noting that the market has been volatile in recent years.

- Battambang: As Cambodia’s second-largest city, Battambang offers a more relaxed lifestyle compared to Phnom Penh. It has a growing expatriate community and is known for its colonial architecture, cultural attractions, and agricultural resources. Property prices in Battambang are generally lower compared to major urban centers, making it an affordable option for investment.

- Kampot: Situated along the banks of the Kampot River, Kampot is renowned for its natural beauty, historic charm, and thriving arts scene. The city has become increasingly popular among expatriates and tourists seeking a peaceful retreat. Property prices in Kampot have been rising steadily, driven by demand for residential and commercial real estate.

Why Do You Invest In Cambodia?

Investing in property in Cambodia offers several potential advantages and opportunities for investors. Here are some reasons why individuals might consider investing in Cambodian real estate:

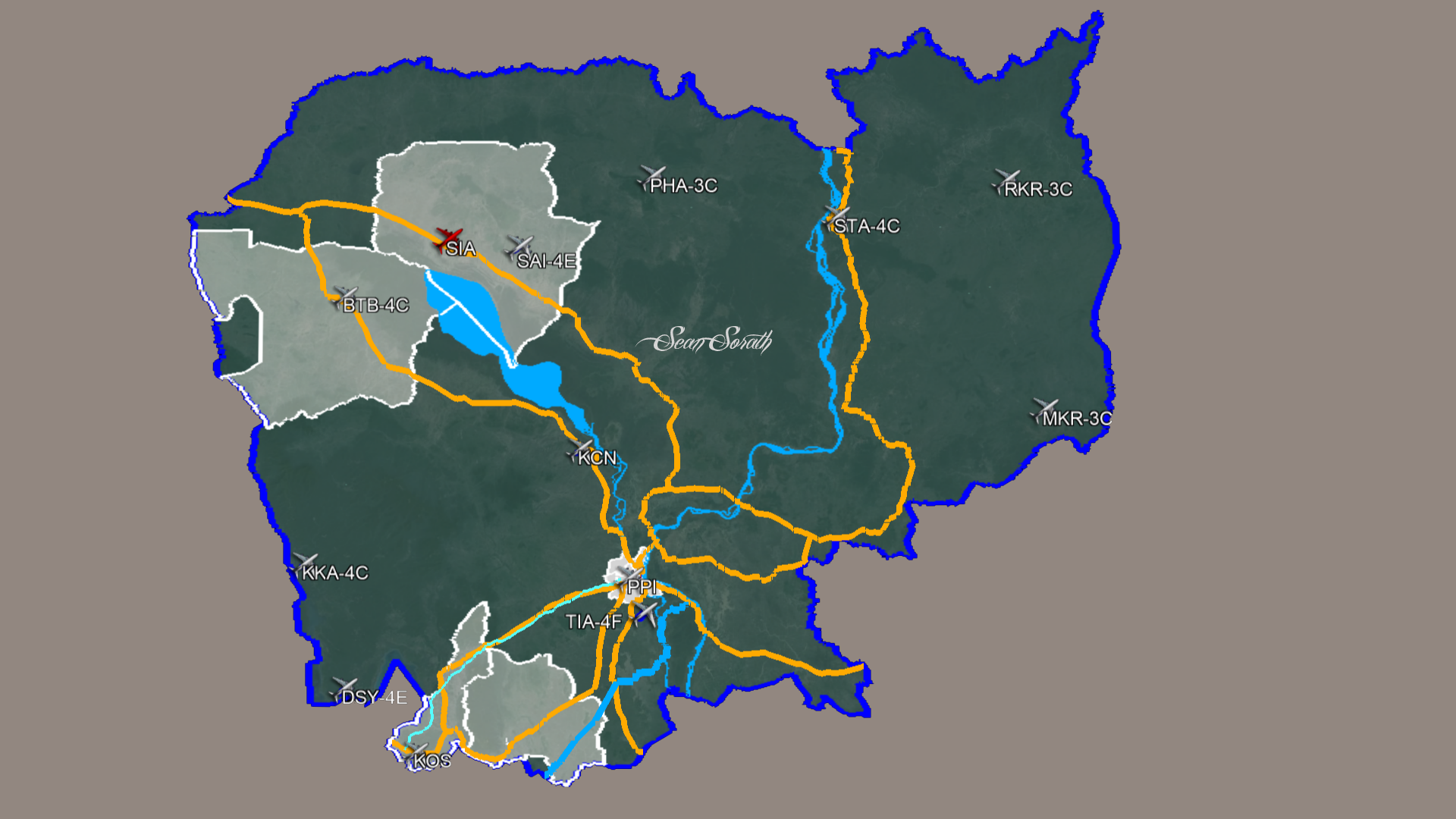

Map of Cambodia with the National Flag

- Rapid Economic Growth: Cambodia has experienced significant economic growth in recent years, driven by factors such as foreign direct investment, tourism, and export-oriented industries. The country’s GDP growth has consistently outpaced the global average, providing a favorable environment for property investment.

- Growing Urbanization: Urbanization is increasing in Cambodia, with a significant portion of the population moving to cities in search of employment opportunities and better living standards. This trend has led to rising demand for residential and commercial properties in urban areas, creating investment opportunities for real estate developers and investors.

- Infrastructure Development: The Cambodian government has been investing in infrastructure projects to support economic growth and urban development. This includes the construction of roads, bridges, airports, and public transportation systems, which can enhance connectivity and accessibility to different parts of the country, thus boosting property values in those areas.

- Tourism Growth: Cambodia’s tourism sector has been growing steadily, driven by attractions such as the Angkor Wat temple complex, tropical beaches, and cultural heritage sites. Tourist arrivals have been increasing, leading to a rising demand for accommodation and hospitality services. Investing in properties catering to the tourism sector, such as hotels, resorts, or vacation rentals, can be lucrative.

- Affordable Property Prices: Compared to some other Southeast Asian countries, property prices in Cambodia are relatively affordable, offering investors the opportunity to enter the market at a lower cost. This affordability can attract both individual investors and institutional investors seeking attractive returns on investment.

- Foreign Ownership Rights: Cambodia allows foreign investors to own property outright, making it an attractive destination for international investors looking to diversify their real estate portfolios. The legal framework for property ownership by foreigners is relatively straightforward, providing clarity and security for investors.

- Potential for Capital Appreciation: With ongoing economic development and urbanization, there is potential for capital appreciation in Cambodian real estate markets. Investors who buy property in promising locations and hold onto it for the long term may benefit from increasing property values over time.

- Favorable Investment Climate: Cambodia offers a relatively favorable investment climate, with incentives for foreign investment, favorable tax policies, and regulatory reforms aimed at improving business transparency and investor confidence. Additionally, the government has shown a commitment to attracting foreign investment and promoting economic growth through various initiatives and policies.

Conclusion

Investing in property in Cambodia presents an enticing opportunity for both domestic and international investors seeking to capitalize on the country’s economic growth, urbanization, and tourism expansion. With a robust economy, growing urban population, and government commitment to infrastructure development, Cambodia offers several compelling reasons to consider property investment.

The country’s affordable property prices, relatively straightforward foreign ownership regulations, and favorable investment climate further enhance its appeal as a real estate investment destination. Additionally, the potential for capital appreciation, rental income, and diversification benefits make Cambodian real estate an attractive asset class for investors looking to expand their portfolios.

However, it’s essential for investors to approach Cambodian property investment with caution and diligence. Conducting thorough market research, assessing risks, understanding local regulations, and seeking professional advice are critical steps to mitigate potential challenges and maximize investment returns.

Furthermore, while Cambodia offers promising opportunities, investors should remain mindful of factors such as political stability, legal uncertainties, and market volatility that could impact investment outcomes. By carefully evaluating these considerations and adopting a long-term investment perspective, investors can position themselves to benefit from the growth potential of Cambodia’s real estate market.

In conclusion, while investing in property in Cambodia may present certain risks and challenges, the country’s economic prospects, favorable investment climate, and potential for capital appreciation make it a compelling destination for savvy investors seeking to diversify their portfolios and capitalize on emerging market opportunities.

Read More

You can read other article about the property knowledge in Cambodia here:

- PREK PRA-CHAK ANGRE BRIDGE STARTS CONSTRUCTION

- SIEM REAP-ANGKOR INTERNATIONAL AIRPORT $1.1B

- WAYS TO INVEST IN PROPERTY

Thanks for reading this article, if you have any doubts or question, please drop your comment below.